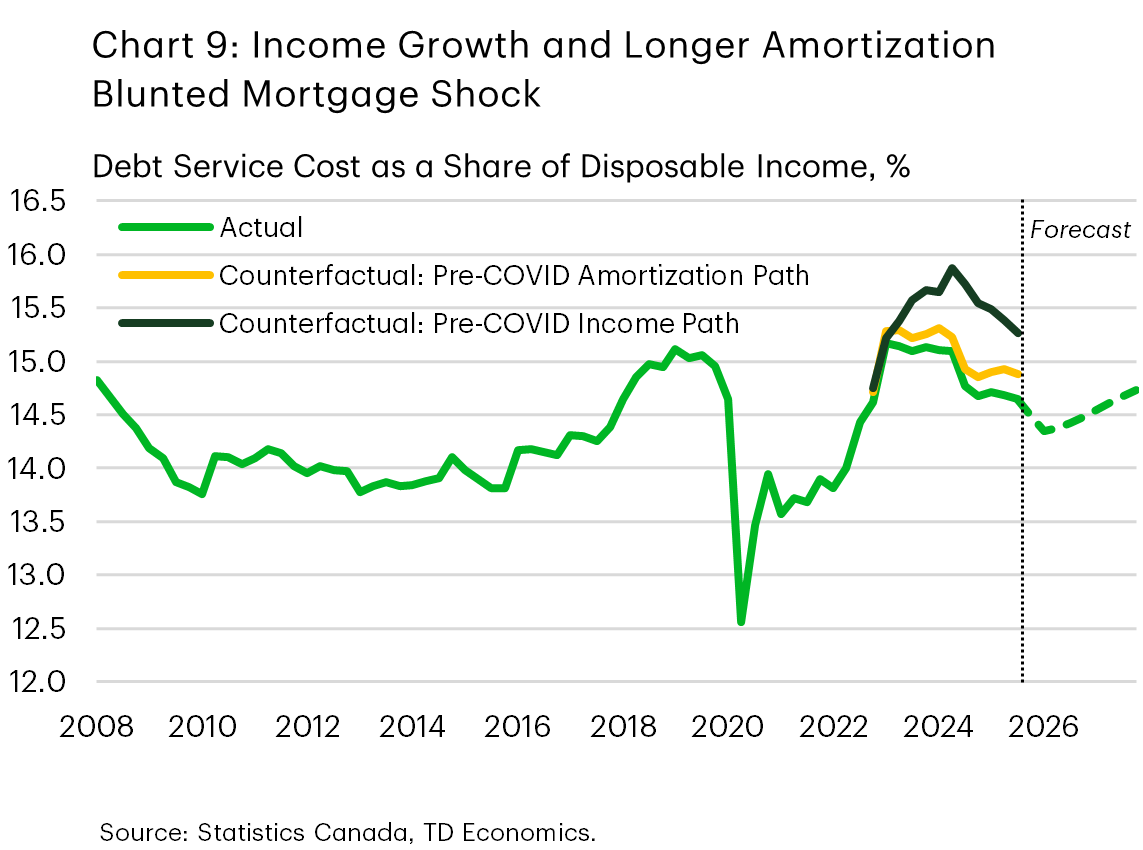

TD Economics argued that Canada’s widely feared mortgage renewal “cliff” has already looked more like a hill, with rising incomes and stretched amortizations cushioning borrowers and limiting the drag on consumer spending.

One worry hanging over the Canadian consumer has been that spending would be held back as mortgages originated at rock-bottom pandemic interest rates renew into higher prevailing rates over the coming quarters.

TD, citing Bank of Canada analysis, noted that 15% of outstanding mortgages would see payments increase in 2026, mostly five-year fixed loans, and that affected borrowers could see payments increase 20%, depending on whether they adjust their amortization length.

Mortgage shock turned into gentler hill

“These figures might give readers pause, but there’s more going on beneath the surface that is expected to leave a much smaller mark on overall consumer spending,” TD Economics said.

“In particular, the debt service ratio for the economy is below its recent highs in 2023, suggesting the period for the worst risk has already past.”

“This lower debt servicing burden exists for two reasons: healthy income growth and longer amortizations,” the analysis said. “The average mortgage amortization has been rising since early 2021 and now sits about 16 months longer than before the pandemic.”

TD added that this helped “smooth the payment shock against rising interest rates in 2022 and 2023, though it was not the dominant driver.”

“The more important factor has been stronger growth in personal disposable income,” TD said, arguing this has “turned a mortgage ‘cliff’ into a much gentler ‘hill’.”

It estimated personal disposable income growth over the past three years ran roughly two percentage points faster than in the three years before the pandemic, and that otherwise the debt service ratio would have peaked about one percentage point higher.

“That income strength also helped to boost the savings rate moderately above trend, providing another cushion for Canadian consumers.”

TD expects “downward pressure on aggregate debt payments as lower policy rates gradually feed through to debt-servicing costs – a process that historically takes four to six quarters.”

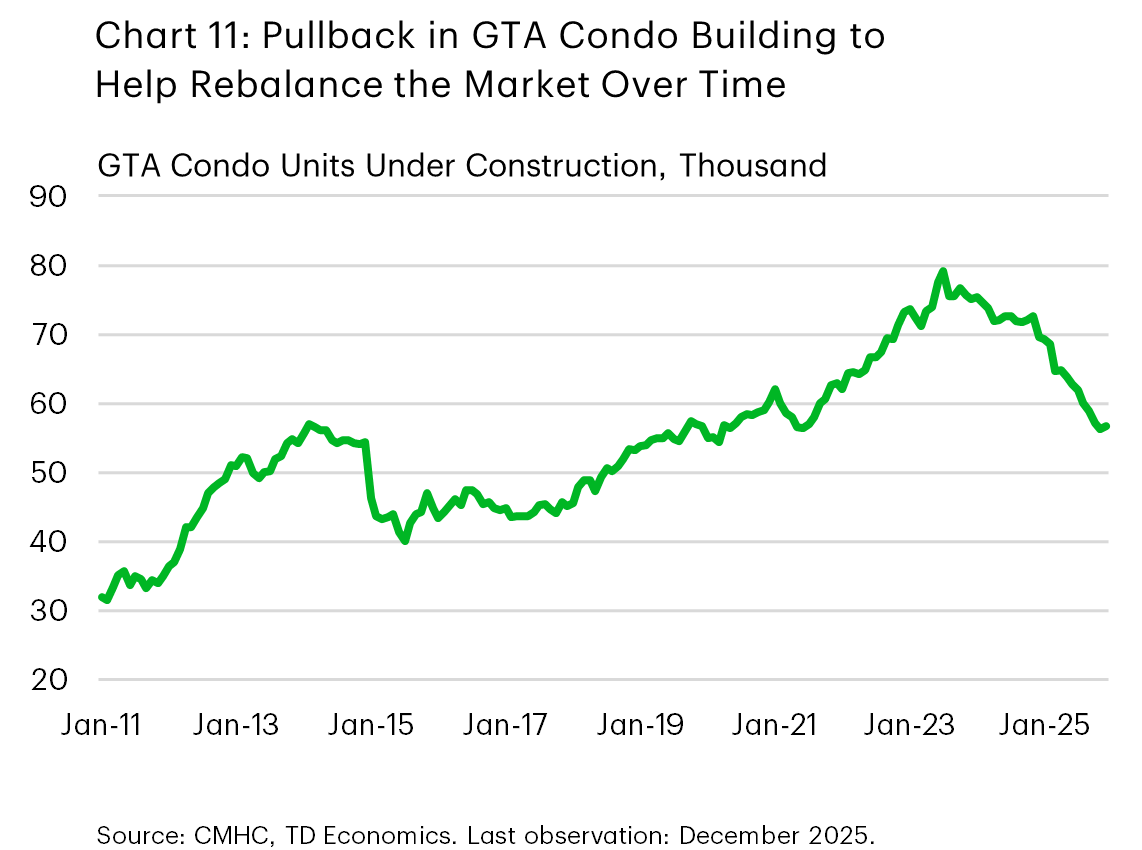

Housing recovery delayed, not derailed

On housing, TD said “the market hasn’t turned yet.” Recent data showed “a weaker-than-expected first quarter for home sales and prices, especially in B.C. and Ontario,” leading the bank to trim its outlook.

“Canadian average home price growth is likely to be closer to 1% rather than the 4% expected in our December outlook,” it said – a marked downgrade that nonetheless implied “a gradual, modest recovery supported by pent-up demand.”

“A strong rebound looks unlikely given multiple headwinds: elevated supply in key regions, slow population growth, softer labour markets, and still stretched (but improving) affordability in Ontario and B.C.,” TD said.

It expects conditions to improve in 2027 “in parallel with an improvement in the economy and affordability,” with modest population growth lending “a helping hand in 2028 or 2029.”

Supply is also projected to tighten as construction stays on the sidelines in over‑supplied pockets, including what TD called “the GTA condo market, which is famously the weakest market in the country.”

“In terms of risks, economic underperformance poses a downside risk,” TD said, pointing to the potential for weaker employment to amplify renewal stress. “However, upside potential also exists if falling prices unleash the significant pent-up demand that exists within Ontario and B.C. faster than we expect.”

The bank noted Canada has “seen this before” when surging sales in 2023 and 2024 caught forecasters off‑guard.

CMP

No comments:

Post a Comment