For much of the past three years, Canada’s so‑called mortgage renewal cliff has loomed as a systemic risk. Now a new TD Economics report by Maria Solovieva, CFA, argued that the worst of that shock appeared to have passed, and that the drag on consumer spending from soaring payments started to ease.

Debt service pressures started to ease

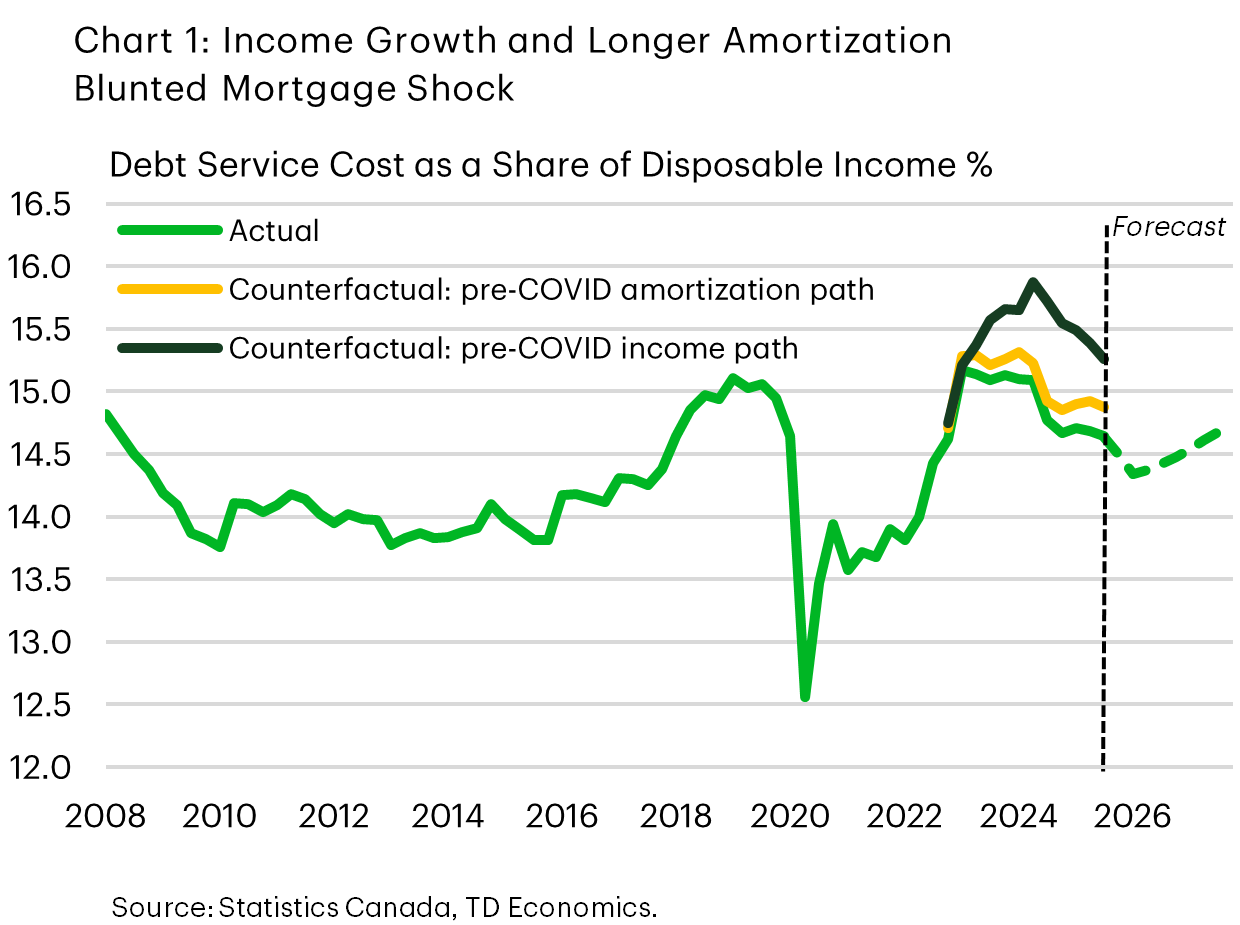

According to TD’s internal data, households were devoting a smaller share of income to servicing debt than a year earlier, with the debt service ratio below its 2023 peak.

“The most telling sign that Canadian households have weathered the renewal shock is also the simplest: they are spending less of their income on debt,” Solovieva said.

She said two forces did the heavy lifting: faster‑than‑expected growth in personal disposable income and longer amortizations, which were roughly 16 months longer than before the pandemic. That combination “turned a mortgage ‘cliff’ into a much gentler ‘hill’,” she said.

The structure of the mortgage market also shifted. By 2026, about 73% of outstanding mortgages were either variable‑rate or short‑term fixed, compared with 55% in early 2022. That meant a larger share of the stock reacted quickly as rates fell.

“Recent interest rate cuts should pass through to borrowers more quickly than rate hikes did during the tightening cycle,” Solovieva said.

From cliff to rolling hill of renewals

The report’s conclusion echoes the Bank of Canada’s own work. The central bank estimated that while roughly 60% of mortgages would renew in 2025–26, “we do not expect upcoming mortgage renewals will lead to a severe worsening of financial stress,” provided incomes continue to rise and rates stay below borrowers’ stress‑test levels.

TD’s modelling showed average mortgage payment increases moderating to about 6% in 2026, with a median change near zero as more borrowers roll into lower rates.

The national debt service ratio is expected to edge higher in late 2026, but mainly because of new mortgages attached to higher home prices, rather than renewed pandemic‑era loans.

Mortgage interest costs in the CPI already decelerated sharply, with mortgage interest cost inflation running about 1.2% year‑over‑year in January 2026, down from a peak above 30% in 2023 – a lagging sign of easing pressure.

CMP