Chances of a Bank of Canada interest rate cut in the first half of 2026 appear to be fading rapidly, with the C.D. Home Institute's Monetary Policy Council (MPC) recommending that the overnight rate remain at 2.25% throughout January 2027.

The council, which acts as a shadow Governing Council to the Bank, called for the target to remain at 2.25% at the next announcement on January 28 and “maintain it at that level until January 2027.”

It said its recommendation reflected a judgement that “the current stance of monetary policy and the economy were consistent with inflation converging with the 2% target over time.”

Composed of chief economists from the six largest Canadian banks alongside academic and market experts, the MPC provided an “independent assessment of the monetary stance needed to achieve the Bank’s 2% inflation target.”

The body’s chair for this meeting, C.D. Howe president and CEO William B.P. Robson, oversaw votes on the upcoming rate call, the following meeting, and decisions six and 12 months out.

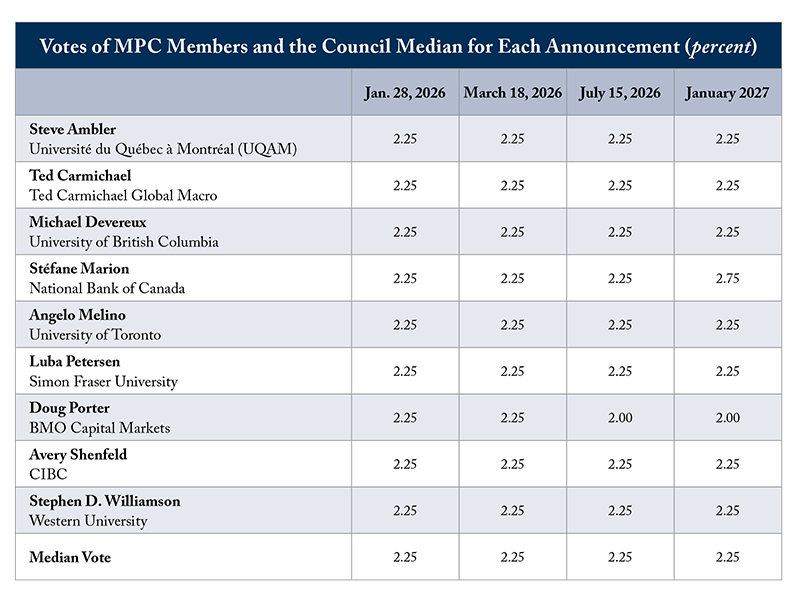

All nine members at the meeting backed holding the overnight rate at 2.25% for both January and March. Eight of nine recommended the same level in July, with one member opting for 2.00%. For January 2027, seven members stayed at 2.25%, one opted for 2.00% and one for 2.75%, underscoring a narrow range of views around a flat path.

MPC members acknowledged “somewhat more robust growth” in the global economy, largely

from the United States, but pointed to a “loss of growth momentum” in Canada and weakening business investment.

They judged that inflationary pressure was dropping even after a December CPI uptick, and that higher prices for items such as coffee and beef did not threaten progress toward the 2% target. Although only one member voted for an immediate cut, “several felt that the balance of risks tilted in that direction.”

Uncertainty around population estimates, temporary residents and the Canada–US trade relationship remained central to the debate. Still, slower payroll growth, a higher unemployment rate and moderating wage and unit labour cost growth boosted members’ confidence that inflation would continue to ease.

CMP

No comments:

Post a Comment